Florida Eliminates Sales Tax on Commercial Rent: What Landlords and Tenants in Miami-Dade Must Know Before October 1, 2025

By Claudia Splinter | South Florida Commercial Real Estate Advisor

August 5th, 2025

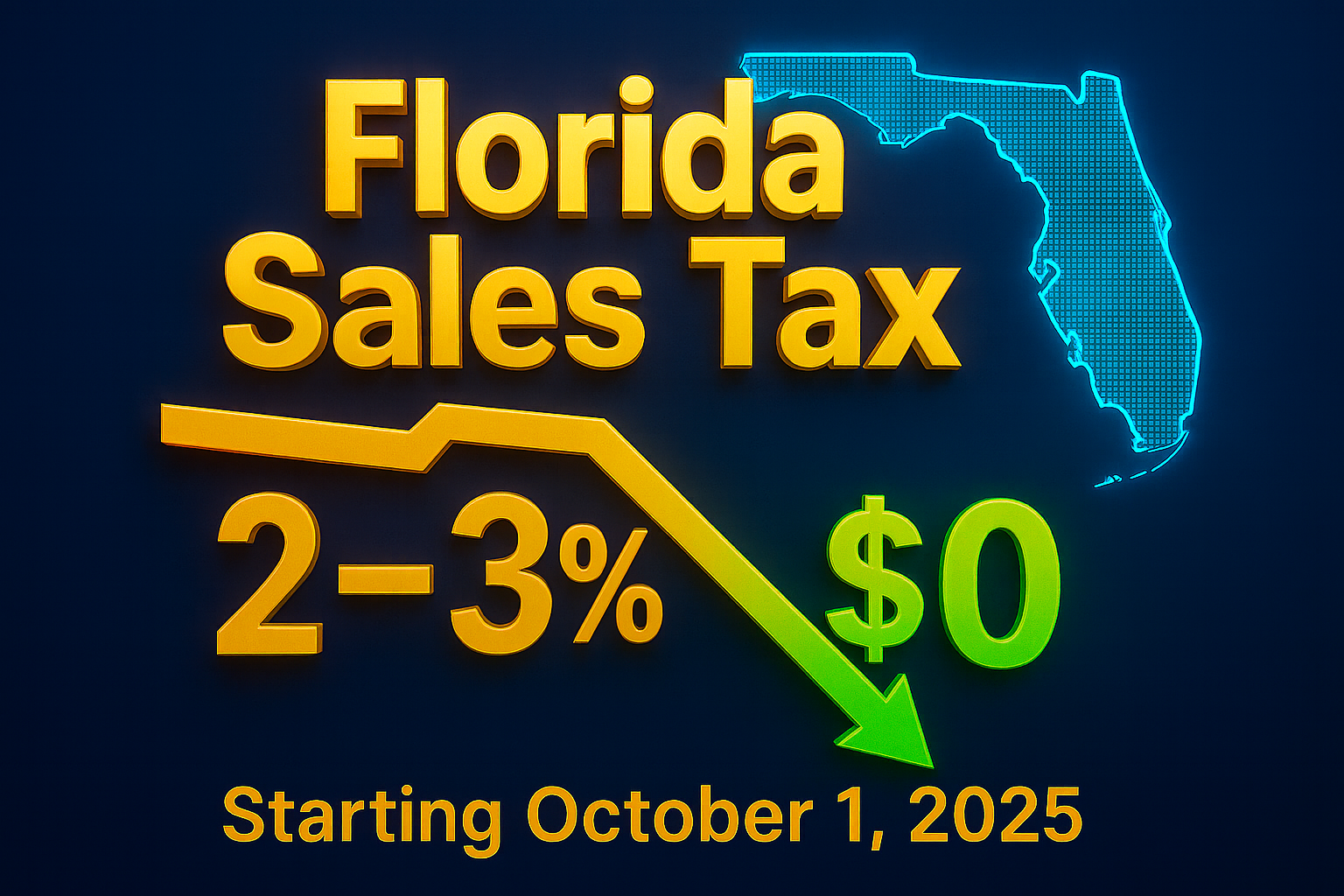

Big news for commercial real estate in Florida—especially right here in Miami-Dade. Starting October 1, 2025, the state of Florida is eliminating all state and local sales tax on commercial rent.

Office space? Industrial? Retail storefront? Gone is the extra 2%+ tax burden that tenants have been paying every month. This historic tax change, part of House Bill 7031, signed into law by Governor Ron DeSantis on June 30, 2025, marks the first full repeal of Florida’s “Business Rent Tax” since it was enacted over five decades ago.

Why This Is a BIG Deal for Miami-Dade?

For over 50 years, Florida stood alone as the only state to impose a statewide sales tax on commercial real estate leases. In a region like Miami-Dade, where commercial real estate drives local business growth, this tax added unnecessary friction to doing business.

Now, that changes. The repeal is projected to save Florida businesses nearly $1 billion annually, and will give Miami-Dade a significant edge when it comes to attracting, growing, and retaining companies—both local and national.

Benefits for Landlords:

- Simplified Billing: Say goodbye to collecting and remitting sales tax on rent. This means fewer admin headaches and cleaner lease structures.

- Stronger Leasing Incentives: Removing the tax lowers the effective rent, helping you compete in a crowded market—especially critical for office leasing, which has lagged post-COVID.

- Property Value Boost: As net operating incomes rise (with fewer taxes deducted), property valuations could improve.

- Better Negotiating Power: That 2%+ savings can now be used to close deals or offer other tenant incentives.

Benefits for Tenants & Business Owners:

- Immediate Rent Reduction: Expect a 2–3% drop in your lease payment—without renegotiating your base rent.

- More Working Capital: That monthly savings can now go to staffing, equipment upgrades, inventory, or expansion.

- More Competitive Subleases: If you sublease space, your offer is now more attractive without the extra tax markup.

- Easier Budgeting: Straightforward lease payments = better cash flow forecasting.

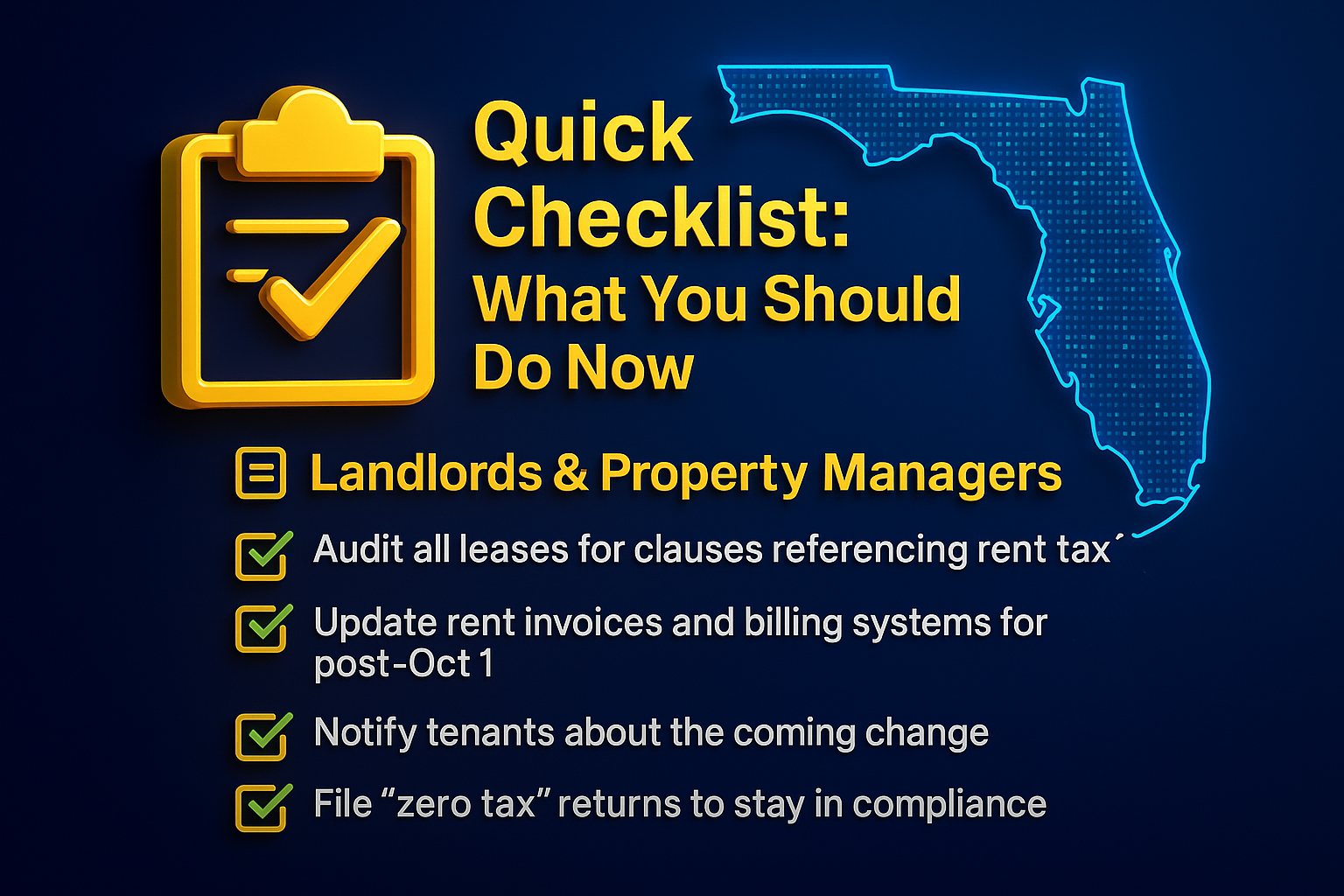

What Landlords Should Expect:

- Update Billing Systems: All rent paid for periods starting October 1, 2025, must be tax-free. But rent for periods prior to that date is still taxable—even if paid late.

- Notify Tenants: Make it clear how the tax change affects their lease and rent due.

- Continue Zero-Tax Filings: You’ll still need to file “zero-dollar” sales tax returns post-repeal to remain compliant and avoid future issues when selling the property.

- Review Your Lease Language: Remove or revise tax clauses to reflect the post-October 1 landscape.

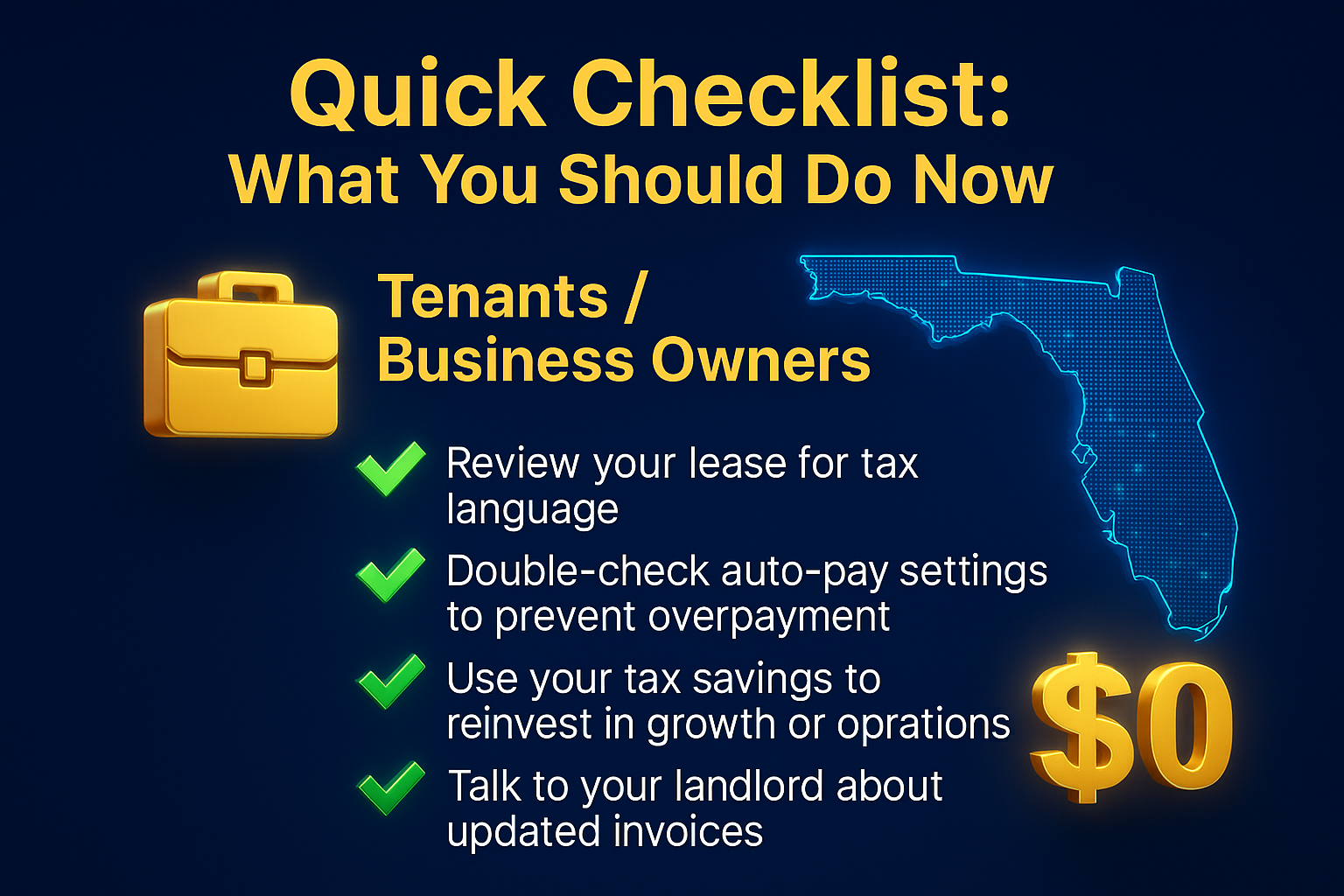

What Tenants Should Expect:

- Expect Rent Savings—but watch the dates: Rent for time periods before October 1 is still taxable, even if paid afterward.

- Check Auto-Pay Settings: Make sure your accounting or rent payment platform doesn’t keep applying sales tax past the deadline.

- Talk to Your Landlord: Confirm their plan to stop collecting sales tax and update invoices.

- Subtenants Alert: If you sublease, inform your subtenants about these changes too.

What’s Still Taxable?

Not everything is exempt. Certain rentals remain taxable, including:

- Short-term residential rentals (under 6 months)

- Parking spaces

- Equipment rentals

- Boat slips

- Vending and kiosk licenses

If you’re unsure, consult a commercial tax attorney or advisor.

The Bigger Picture:

Florida’s repeal of the business rent tax is more than a financial win—it’s a strategic shift. This move makes Miami-Dade and the rest of the state far more competitive compared to business hubs like New York, California, or Illinois, where rental tax burdens are higher or harder to navigate.

According to Florida Realtors, every $1 saved from this tax elimination could generate $6 in economic activity. Expect:

- Faster lease-ups

- More business relocations to Florida

- Higher commercial demand in high-growth areas like Wynwood, Brickell, Doral, and Hialeah.

Quick Checklist: What You Should Do Now:

Landlords & Property Managers:

Quick Checklist: What You Should Do Now:

Tenants / Business Owners:

Final Take: Don’t Miss This Window:

This isn’t just a tax change—it’s a once-in-a-generation shift in how Florida does business. Whether you’re leasing office space in Coral Gables, running a warehouse in Medley, or investing in retail on Calle Ocho, this impacts your bottom line.

Now’s the time to prepare your leases, update your processes, and communicate clearly with tenants or landlords before October 1, 2025.

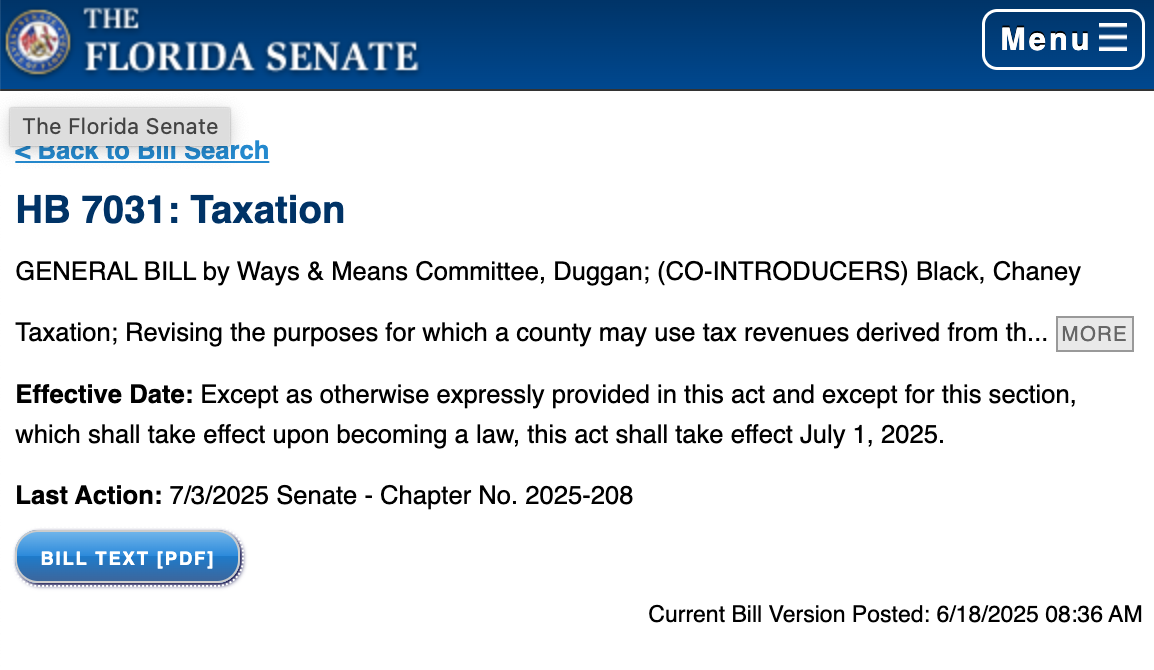

Want Access to the Full Bill? Here’s How:

To read the full enrolled text of House Bill 7031 and track its legislative history, use the following official sources:

Quick Links & Navigation Tips:

- Florida Senate Website: Visit Florida Senate → navigate to Session → Bills → HB 7031 (2025). Here’s the official government link where you can access the full enrolled text (PDF) and track the legislative history of House Bill 7031 → southern.fl.networkofcare.org+8The Florida Senate+8Florida House of Representatives+8

- Florida House of Representatives: Go to myfloridahouse.gov → Search for “HB 7031” to access the summary page, final text, and voting history.

- LegiScan: Visit LegiScan.com → Enter “HB 7031” in the search bar to → find the “Latest bill text (Enrolled)” PDF → summary and status → The Florida Senate+2LegiScan+2LegiScan+2

What You’ll Find in the Bill:

- Downloadable PDF of the enrolled bill text

- Legislative status updates

- Status updates and bill tracking

- Formal references to the statutory repeal of the business rent tax

- Full repeal of Section 212.031 of the Florida Statutes, Elimination of the 2% state sales tax on commercial leases, including applicable local discretionary surtaxes

- Effective Date: October 1, 2025

- Signed into law by Governor Ron DeSantis on June 30, 2025

Let’s Talk:

Need help preparing your leases or making sense of the bill?

I’m Claudia Splinter, your Miami-Dade commercial real estate expert.

DM me, call me, or shoot over an email—let’s make sure you’re ready and ahead of the curve.

Like, share, and follow for more commercial real estate insights in South Florida!

For personalized advice and to explore how Trajan CRE can assist your business, contact us today!

Read our other articles:

What Is the Current Sales Tax on Commercial Property Rentals in Miami-Dade?

Rate Rant: What the Fed Controls—And What It Doesn’t