What Is the Current Sales Tax on Commercial Property Rentals in Miami-Dade?

Florida’s 2024 Commercial Rental Tax Rates: What Businesses Need to Know

Did You Know? Florida Has Reduced Taxes on Commercial Rentals!

Welcome to the Trajan CRE Blog, where we keep you updated with the latest in commercial real estate news and trends. We’re excited to share a major development related to the Florida commercial rental tax that can benefit your business and your investments in commercial real estate.

What Is the Current Sales Tax on Commercial Rentals in Florida?

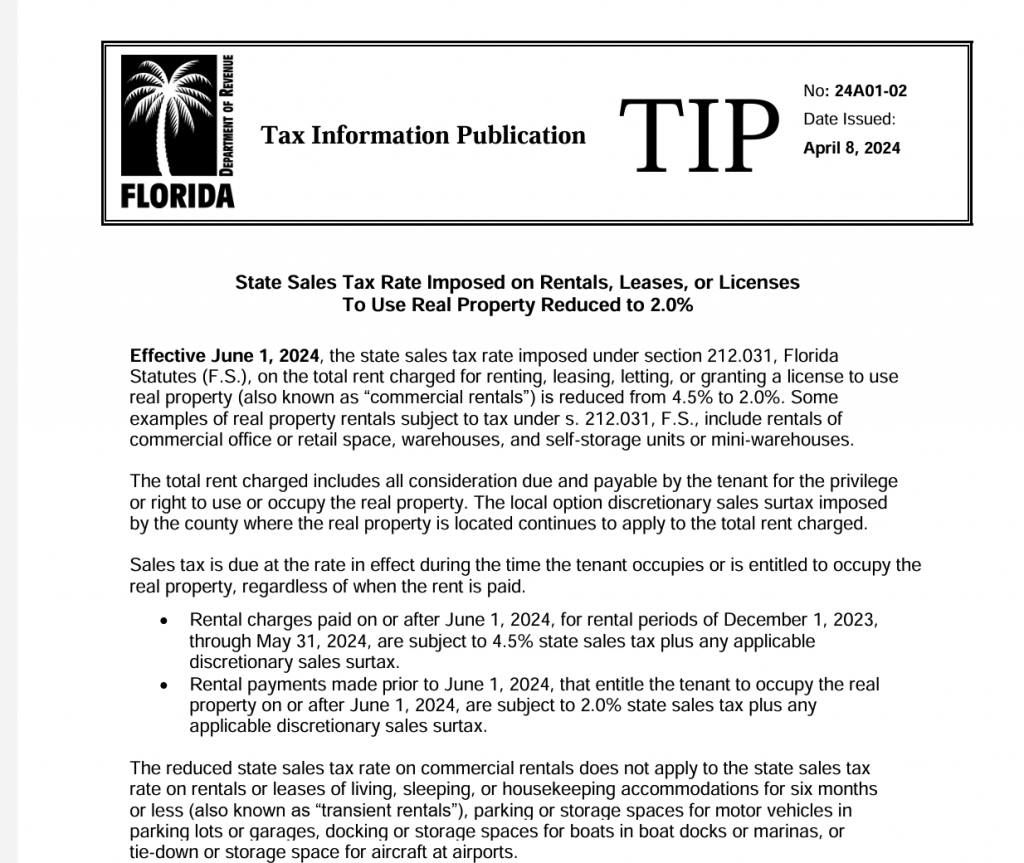

As of June 1, 2024, Florida’s sales tax on commercial leases has been reduced from 4.5% to 2.0%, thanks to House Bill 7063. This significant tax cut is designed to ease the financial burden on businesses, making Florida an even more attractive place for commercial investment.

Key Points:

- State Sales Tax Rate: Reduced to 2.0% for commercial leases.

- Local Surtaxes: Additional local surtaxes ranging from 0.5% to 1.5% apply depending on the county.

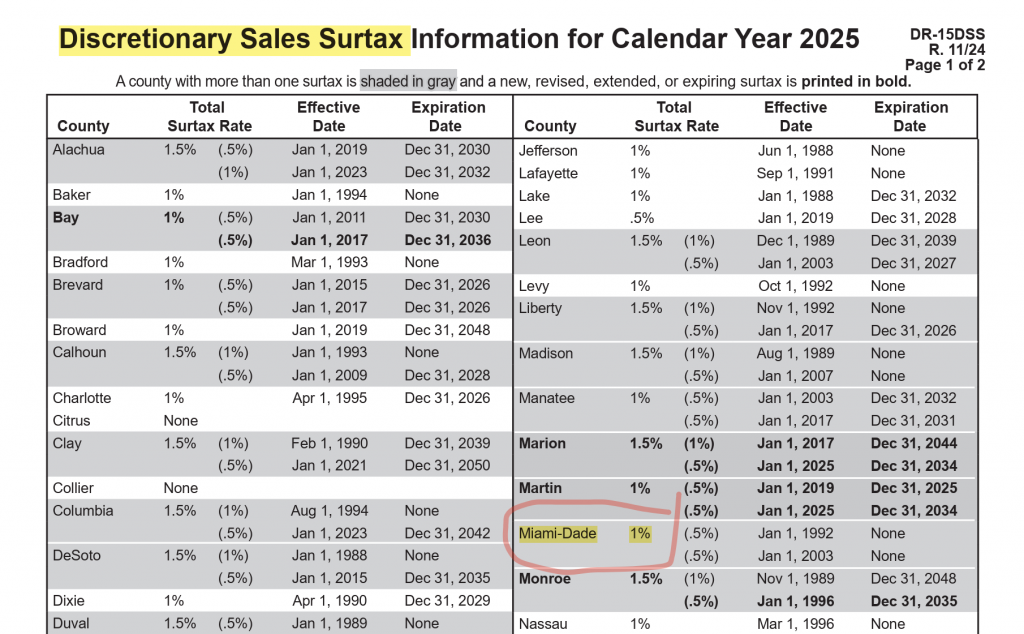

- Miami-Dade Sales Tax Rate: Miami-Dade County imposes a discretionary sales surtax of 1.0%, bringing the total sales tax rate on commercial leases to 3.0%.

This reduction specifically targets commercial properties, excluding residential and short-term accommodations of less than six months. The tax applies to the base rent and additional components like CAM (Common Area Maintenance) charges, property taxes, and insurance.

Understanding the Impact: Navigating the New Tax Landscape

This tax reduction presents a strategic opportunity for businesses:

- Financial Relief: Lower taxes mean reduced operational costs, freeing up funds for reinvestment.

- Competitive Advantage: Florida’s business-friendly tax environment can attract new investments and foster growth.

- Effective Date: The state sales tax rate on commercial rentals was reduced from 4.5% to 2.0% on June 1, 2024.

- Local surtax in Miami-Dade: 1% discretionary sales surtax still applies, making the total 3% in Miami-Dade County.

- Important detail: The reduced rate only applies to rental payments for occupancy periods starting on or after June 1, 2024.

- If a payment was made before June 1, 2024, but the rent applies to a period before that date, the old 4.5% rate still applies.

Below you’ll find a direct link to the official Florida Department of Revenue, where you can review detailed information about the discretionary sales surtax for Miami-Dade and other counties for the year 2025. There, you can see the 1% surtax rate for Miami-Dade, which explains the increase to a total of 3% in sales tax on commercial property rentals.

Exploring County Surtax Rates

To fully grasp your tax liabilities, it’s crucial to understand the additional county surtaxes. Here’s a look at the top counties:

| County | Surtax Rate |

| Brevard | 1% |

| Miami-Dade | 1% |

| Broward | 1% |

| Palm Beach | 1% |

| Hillsborough | 2.5% |

| Orange | 0.50% |

| Duval | 1.5% |

| Pinellas | 1% |

| Lee | 1% |

| Polk | 1% |

Implications for Businesses:

- Location Strategy: Consider surtax rates when deciding where to establish or expand operations.

- Cost Planning: Factor these rates into your budgeting and financial projections.

Why This Matters: The Business Perspective

This tax cut could have wide-ranging effects on the Florida business landscape:

- Reduced Overheads: Significant tax savings could enable businesses to allocate more resources towards growth and development initiatives.

- Increased Investments: Florida’s improved tax climate may attract new businesses, boosting the state’s economy and creating jobs.

Expert Insight:

“Florida’s tax reduction on commercial leases is a game-changer for businesses looking to optimize costs and maximize growth potential in South Florida. This has helped tremendously both business owners and landlords”

— Ariel O. Diaz, CCIM, Real Estate Broker & Analyst at Trajan Commercial Real Estate

How Businesses Can Prepare for the Changes

Preparation is key to maximizing the benefits of the new tax rates. Here are some steps businesses can take:

- Review Current Leases: Assess how the tax changes impact your lease agreements and financial obligations.

- Renegotiate Terms: Consider negotiating with landlords to align your agreements with the new tax rates.

- Consult Tax Experts: Seek professional advice to navigate the complexities of the tax landscape effectively.

- Update Financial Plans: Adjust budgets and financial forecasts to reflect the reduced tax burden.

Impact of Surtax on Businesses and Residents

The variation in county surtax rates across Florida affects businesses and residents differently:

- For Businesses: Higher surtax rates can impact operational costs, influencing decisions on location, pricing, and expansion.

- For Residents: Residents in counties with higher surtaxes may experience a higher cost of living, affecting spending and savings patterns.

Balancing Act: While surtaxes fund essential local services, it’s crucial to weigh these benefits against the higher immediate costs.

Future Predictions and Trends

Looking ahead, potential changes in surtax rates could arise from economic conditions and policy shifts:

- Surtax Extensions: Counties might extend existing surtaxes or introduce new ones to fund infrastructure and public services.

- Business Decisions: Tax rates could influence where businesses choose to locate new stores, offices, or facilities.

Staying Informed: Keeping abreast of these trends is essential for strategic planning and decision-making.

FAQs

What is the new commercial rental tax in Florida starting June 1, 2024?

The Florida Department of Revenue is implementing a new tax structure, reducing the sales tax rate on commercial rentals to 2.0%, impacting rental payments and potentially lowering business costs.

How does the reduced sales tax rate affect rental payments for commercial properties?

The reduced rate applies directly to monthly rental payments, decreasing the overall cost for businesses leasing commercial spaces.

Will the applicable discretionary sales surtax affect my business’s commercial rent tax liability?

Yes, alongside the standard sales tax, the county-specific discretionary sales surtax will continue to apply, affecting your total tax liability. It’s crucial to check your county’s surtax rates for accurate tax commitments.

Conclusion

The changes in Florida’s commercial rental tax offer businesses a chance to reduce costs and maximize growth potential. By staying informed and proactive, you can make the most of these tax benefits. Whether you’re looking to expand your operations or optimize your current arrangements, Trajan CRE is here to assist you every step of the way.

For more detailed information about these changes and how they might affect your business, please visit this link.

For personalized advice and to explore how Trajan CRE can assist your business, contact us today!

Read our other articles: